EPF 101: What Every Malaysian Must Know About the Employees' Provident Fund

Understanding your benefits as an employee is vital in your working life. To know where your earnings go, you need to comprehend your taxes and contributions. If you are not yet familiar with such, look no further! This article will answer all your concerns regarding the Employees’ Provident Fund (EPF) — also known asKumpulan Wang Simpanan Pekerja(KWSP). In our previous articles, you can also learn about your other benefits, such as the Social Security Organisation (SOCSO) and the Employment Insurance System (EIS).

Disclaimer:This article is not a substitute for legal advice. JobStreet will not be held liable for any actions taken based on this article.

What is the KWSP Employees’ Provident Fund (EPF)?

Created under the Employee Provident Fund Act 1991, the EPF is a retirement benefits plan for employees in Malaysia. It acts as social security, providing pensions for those who do not have access to allowances (e.g., private sector workers).

Is the EPF different from SOCSO?

Yes. The difference between the EPF and the SOCSO is that the latter assists victims of workplace accidents. You may read more about the SOCSO here.

How does the KWSP EPF work?

Typically, your employer files your contributions on your behalf. Contributions and savings are managed either by the Simpanan Konvensional or the Simpanan Shariah. While both are savings options for the EPF, only the latter complies with the Shariah law. Muslim members normaly choose the Simpanan Shariah to ensure that their savings adhere to the Shariah principles; however, non-muslim members may also opt for this as an alternative to Simpanan Konvensional.

What are EPF Dividends?

The EPF dividend is similar to the annual dividends that insurance companies give to their clients each year. It deposits yearly payments to your account once it has earned profit from its investment assets. Per year, the EPF dividend varies. Its rates depend on several factors, including market losses, investment costs, and other similar expenditures.

What is the difference between the EPF Account 1 and Account 2?

Your EPF savings contain two accounts, each varying in savings and withdrawal allowances. Account 1 retains 70% of your monthly contribution, while Account 2 holds the remaining 30%.

Withdrawals are restricted in Account 1 until you turn 50 years old. This regulation helps increase your retirement fund, as the EPF uses your savings to make investments that contribute to the annual dividends.

If you need to take out money for reasons permitted by the EPF, you can withdraw from Account 2.

Who is required to make contributions?

Malaysian employees in the private sector and those in non-pensionable posts in the public sector are required to make contributions to the Employees’ Provident Fund. Even if you have ever worked as a contractual employee or under an apprenticeship, you are required to make a contribution.

If you are not a Malaysian citizen or permanent resident but working in Malaysia, the EPF is optional.

How do you calculate your Employees' Provident Fund?

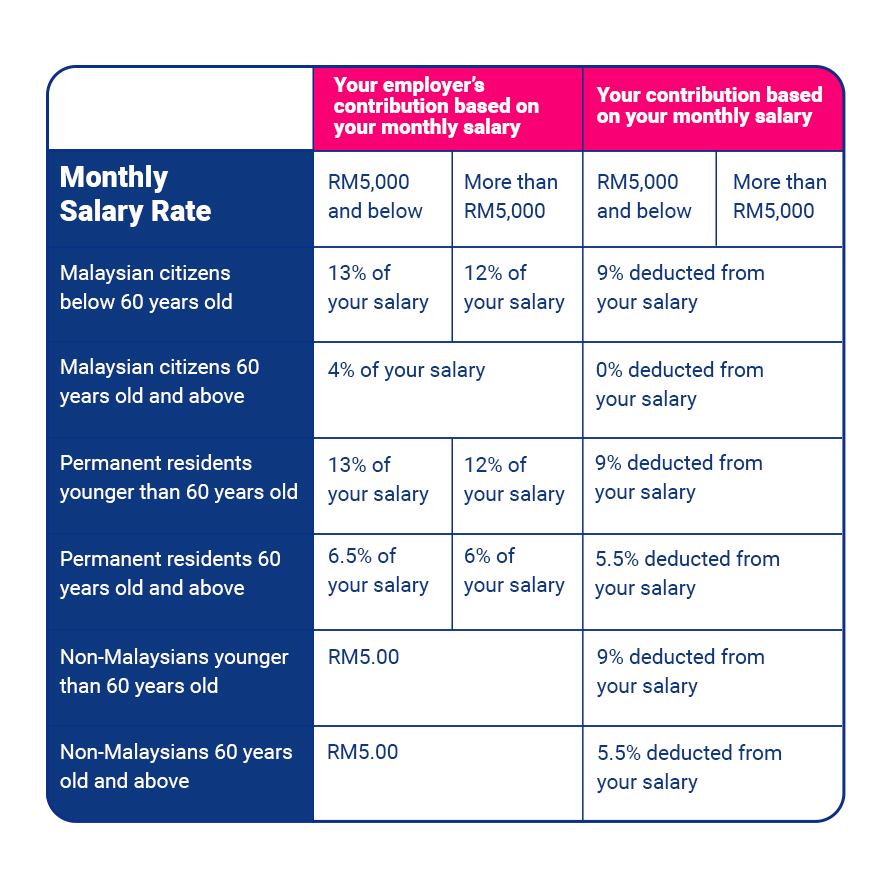

Your Employees’ Provident Fund contribution is split between you and your employer and is dependent on your monthly salary. The table below is the breakdown of employee and employer contributions as of 2022. Source: Employees Provident Fund Official Website

Source: Employees Provident Fund Official Website

Based on the Budget 2022 announcement, EPF contributions decreased from 11% to 9%. If you pay contributions from February 2021 to June 2022, your minimum contribution rate remains 9%. After which, the minimum statutory contribution rate returns to 11%.

On this note, you can still choose to contribute 11% of your salary. To do this, fill out the Borang KWSP 17A (KHAS 2022) form, which your employer will file on your behalf.

Want to see a complete breakdown of your salary deductions, including your EPF contributions? Use JobStreet’s Salary Calculator here.

How are EPF payments made and who files the contributions?

Your employer will file your EPF contribution for you. Both your and your employer’s share of your EPF should be paid by the 15th of each month. The EPF charges a fee for late payments, so make sure you check if you made your contributions on time.

What payments or components are liable for EPF deduction?

Take note that the following payments are subject to EPF deductions:

- Salaries

- Payment for unused vacation or sick leave

- Bonuses

- Some allowances

- Commissions

- Incentives

- Wage arrears or errors in your payroll

- Salaries earned during maternity, study, or half-day leaves

- Other contractual payments

On the other hand, these payments are not subject to EPF deductions:

- Service charges such as tips

- Overtime payment, including those for work rendered on rest days and public holidays

- Gratuity or the payment you receive at the end of a service period or when you resign

- Payment when given a notice of termination and termination benefits (if applicable)

- Retirement benefits

- Travel allowances

- Director’s fee

- Gifts and cash payments given during holidays (e.g, Hari Raya and Christmas Day)

- Gifts or benefits given in kind

How can I check my EPF balance?

You can quickly check your EPF balance online. Contact the EPF office and request a temporary username and password. Activate your account and log into the online portal, where you will see your contributions.

When can I withdraw my EPF?

You can fully withdraw your EPF under these circumstances:

- You turn 55 years old

- You are leaving the country or migrating to another country

- Death or incapacitation

If these apply to you, you will need to fill out certain forms and submit requirements. You can find more details based on each circumstance here.

Remember that you can also withdraw a partial amount of your EPF if you do not meet the qualifications above. The Malaysian government understands that you may need to dip into your pension for essential expenses such as:

- Big home purchases

- Building a house

- Paying a house loan

- Medical expenses

- Funding your or your children’s education

- Taking a trip to perform Hajj

- Planning for retirement (applicable for those 50 years old and above)

As mentioned earlier, you may withdraw this amount from your Account 2. There are specific requirements for each expense which the EPF website details here.

Knowing how much goes into your EPF each year is crucial, so you should know where your hard-earned money goes. Understanding your EPF deductions and your income tax calculation help you stay informed of your rights and benefits.

After learning more about EPF, begin your search for the #JobsThatMatter. Update your profile at JobStreet and find work that will bring you passion and purpose. Finally, visit the Career Resources Hub for more expert tips and advice on your rights and benefits as an employee.