Common Income Tax Filing Violations and How to Avoid Them

As a responsible Malaysian citizen and employee, you must be aware of your obligations that come with earning a paycheck. This includes learning and filing your income tax (cukai pendapatan). If you are employed, your employer should remit your income taxes to the Lembaga Hasil Dalam Negeri Malaysia (LHDN) or Inland Revenue Board (IRB). If you’re self-employed or a freelancer or are filing for tax relief, it is important to know the rules and deadlines to avoid an income tax filing violation.

Every Malaysian individual (resident or non-resident) is required to file income taxes if their annual employment income is at least RM34,000 after their EPF ( Employees’ Provident Fund ) deductions. The EPF is a compulsory savings and retirement plan for employees working in the Malaysian private sector. Non-residents are required to pay a flat rate of 30% of their total taxable income.

Tax reliefs

There are incomes exempted from tax. These are called tax reliefs, which include medical expenses, educational fees, and childcare expenses. In 2023, dental treatments now qualify for tax relief. Tax Testing for COVID-19 and the special tax relief of RM2,500 for the purchase of work-from-home equipment such as mobile phones, computers, and tablets are also included here.

Tax filing deadline

If you are employed, the deadline for filing your taxes online is usually on April 30. Keep in mind that while there is a grace period of 15 days, you are encouraged to file your taxes on time to avoid penalties, as per Income Tax Act 1967. Remember to check if the government has announced an extension but do not wait until the last minute.

Common Income Tax Filing Violations In Malaysia

Here are some of the common income tax filing violations to avoid and the penalties for each.

1. Not filing your taxes

If your annual employment income is at least RM34,000 (after your EPF deduction), you are required to file your taxes. Failure to file your taxes on time can lead to a fine between RM200 to RM20,000, imprisonment, or both. The penalty is a 10% increment from the tax payable, and an additional 5% increment on the balance if the payment is not made after 60 days from the final date.

2. Misreporting your earnings to LHDN

Declaring that you earn a lower income than your actual salary means you may be paying less in taxes. However, the risk is a fine of RM1,000 to RM 10,000, and you will have to pay 200% of the amount that was undercharged.

Underreporting your income can be an honest mistake if you are not familiar with taxable and non-taxable incomes. Aside from your salary, income from rent, dividends, and royalties also fall under taxable income. Make sure you cover all your bases. If you are in doubt, you can reach out to your nearest LHDN office or send a message to the LHDN Customer Feedback via their website.

3. Overstating your tax reliefs

Filing tax reliefs can save you money, but proceed with caution when you declare them. Overstating tax relief to get lower tax charges can get you in trouble. If you do not have the supporting documents to back up your tax relief, you can be fined RM300 to RM10,000, imprisonment, or both.

The Malaysian government has a list of all items that qualify for tax relief. For more information, you may check the LHDN website.

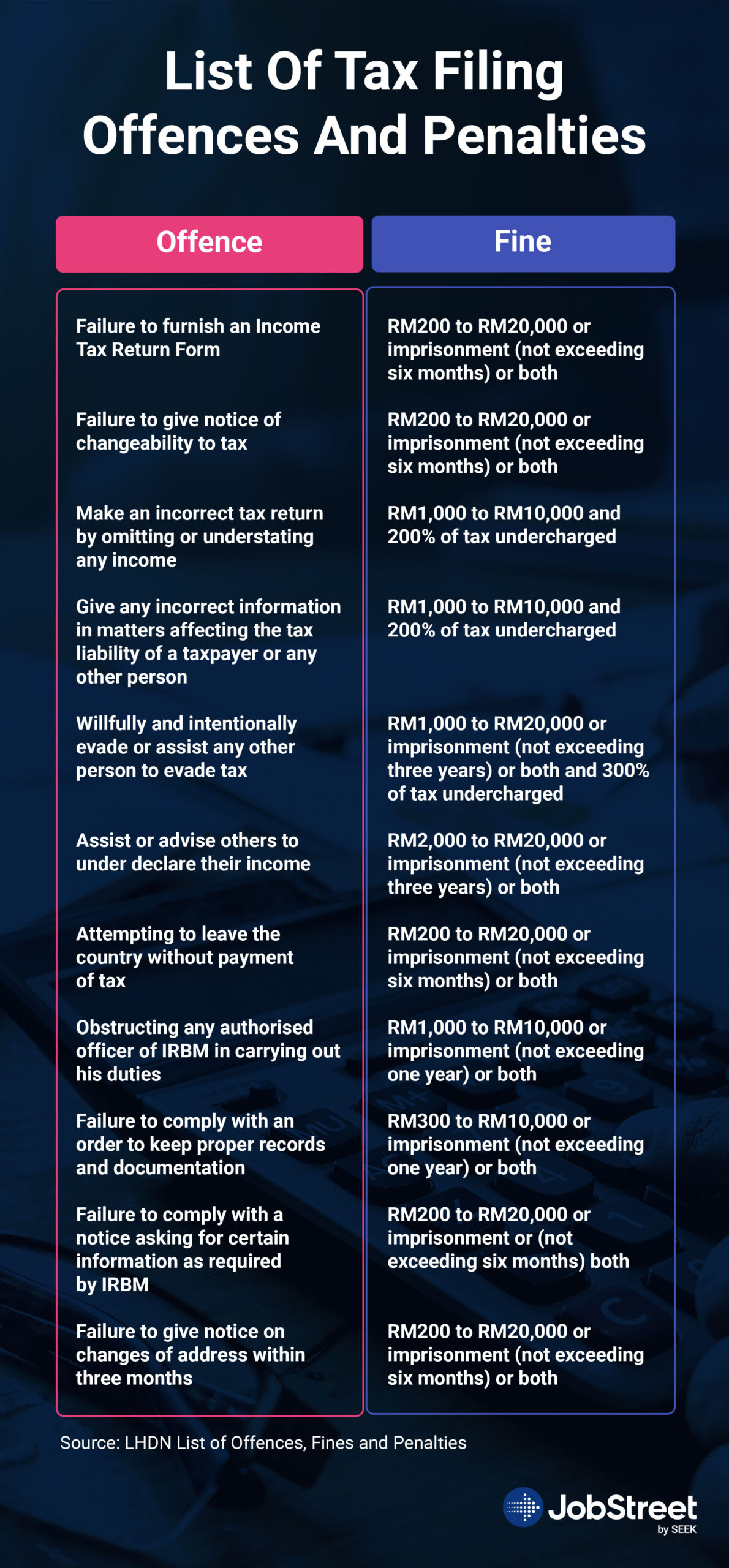

List Of Tax Filing Offences And Penalties

Aside from the offences listed above, below is a table from the LHDN website that lists other income tax filing violations.

What do you do if you make a mistake in filing your taxes?

If you have already submitted your tax return form and then realised that you made a mistake, there are ways to correct it. The LHDN lists the following steps so you can make an amendment:

If you will submit the amendment before the tax deadline:

Write a letter describing the mistake and include the documents to support it. You must submit this letter and the supporting documents to the LHDN branch that manages your tax file. If you are not sure where this branch is, send a message at the LHDN Customer Feedback website.

If you will submit the amendment within six months from the last day of the tax deadline:

Fill out the Amended Return Form (ARF) to the LHDN branch that manages your tax file. Take note that only taxpayers who have submitted their tax returns on time can do this.

Summary

Knowing the different income tax filing violations and how to avoid them are just as important as understanding your income tax and knowing how to file them. Remember the tax filing deadline and take note of the possible penalties so that you do not forget to file your tax forms. Finally, check the LHDN website for any updates or changes to the guidelines for income tax filing.

Now that you know more about tax offences and penalties, it is time to #SEEKBetter work. Update your profile at JobStreet and find the work that aligns with your passion and purpose.

For more expert tips and advice on work-life and personal well-being, check out our Career Resources Hub.